Mergers and acquisitions (“M&A”) are often an essential strategy for companies looking to grow, adapt, or secure a competitive advantage. Gaining a basic understanding of M&A deals can help business leaders navigate these opportunities, allowing for informed decisions on expansion or sale while managing associated risks.

A Quick Overview of Mergers

In a merger, two companies agree to combine their operations, often to achieve economies of scale, increase market share, or enhance operational efficiency. For business owners with aligned goals, merging can create a unified entity that leverages the strengths of both parties to achieve broader market impact.

A Quick Overview of Acquisitions

In an acquisition, one company or individual purchases another company’s assets or equity, typically in exchange for cash, stock in the acquiring company, or a combination of both. Larger companies or private equity firms often initiate acquisitions to fuel growth and consolidate operations, potentially with plans for a future sale. Sellers may opt to sell for various reasons, such as retirement, estate planning, or transitioning to new opportunities. For example, career entrepreneurs may sell successful startups to larger corporations, or smaller companies may join a larger entity for expanded opportunities.

Common Types of M&A Transactions

M&A deals vary in structure, depending on strategic objectives. The four main types include:

- Horizontal M&As: This occurs when two companies in the same industry merge to increase market reach. An example is two hardware companies combining to create a single, more extensive entity.

- Vertical M&As: This involves companies along the same supply chain merging to streamline production or distribution. For instance, a car manufacturer acquiring an engine company would be a vertical acquisition.

- Conglomerate M&As: Companies from unrelated industries combine to diversify product offerings. A conglomerate might include divisions for outdoor gear, entertainment and office equipment under one brand.

- Concentric M&As: Different companies come together to offer complementary products to the same customers. An example would be an electronics company acquiring a headset manufacturing brand to serve gamers comprehensively.

Understanding these M&A types can help business owners consider how best to align their goals with potential partners or acquisition targets.

Structuring M&A Transactions

M&A deals are structured with a focus on minimizing liabilities and reducing tax implications. Common structures include:

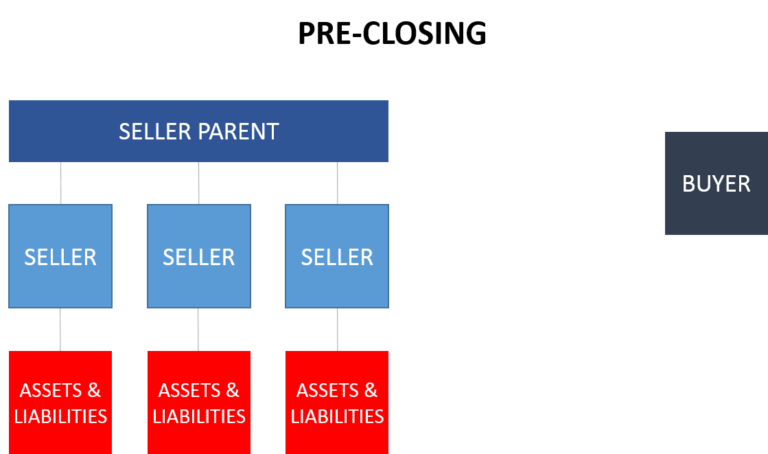

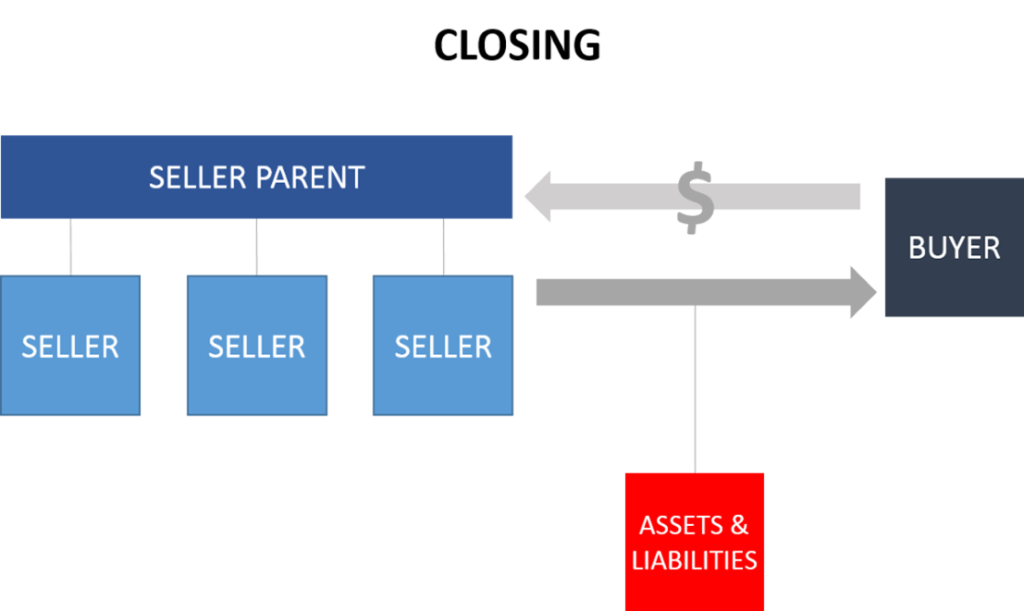

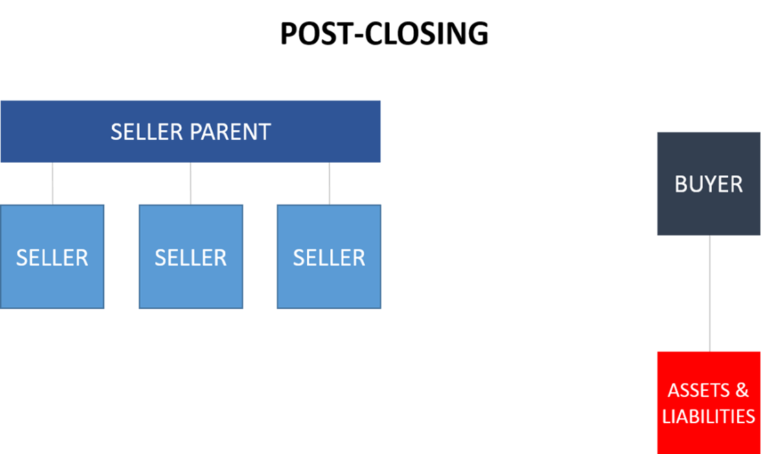

- Asset Sales: The buyer acquires specific assets, often without taking on the company’s liabilities. Here is an illustration of an asset sale:

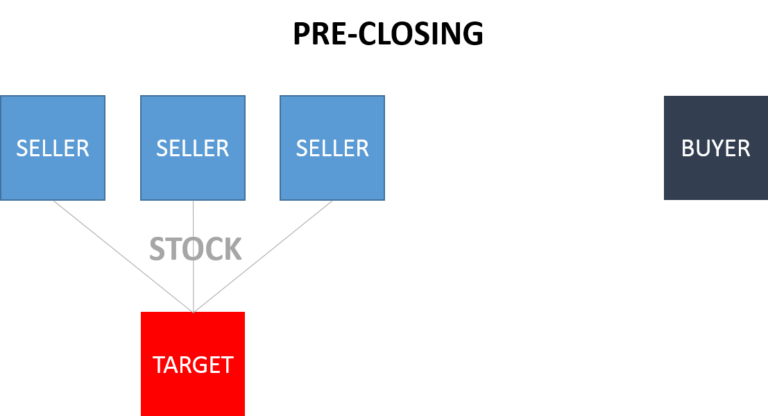

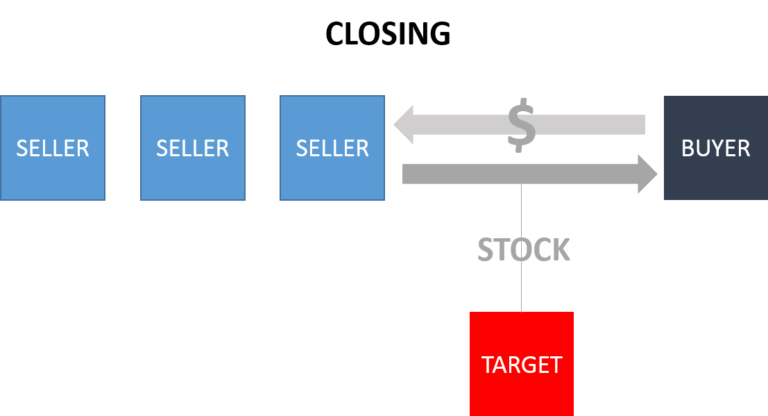

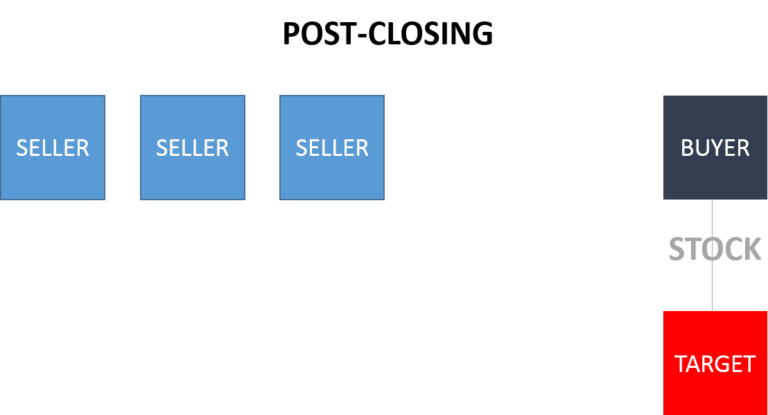

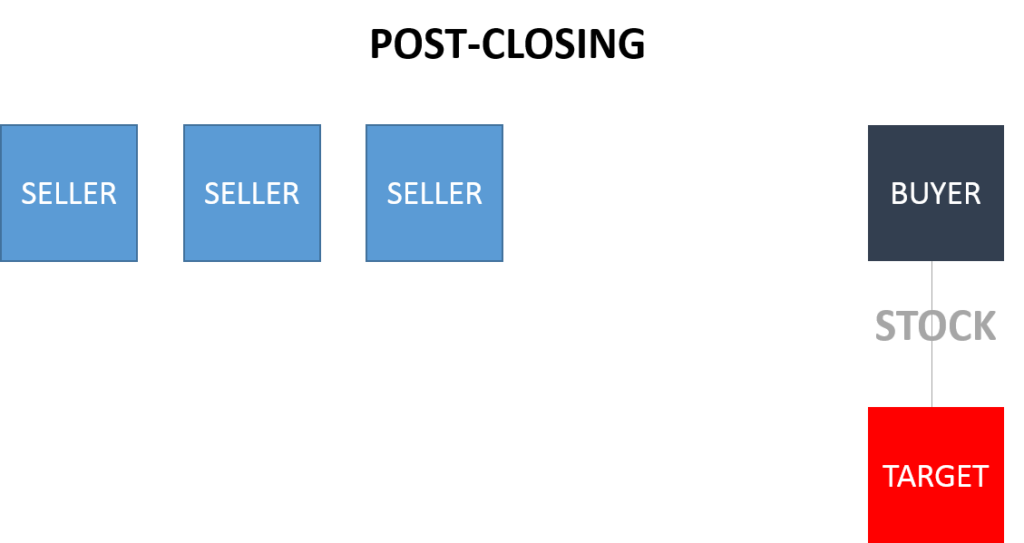

- Stock Sales: The buyer purchases the seller’s stock, acquiring both assets and liabilities. Here is an illustration of a stock sale:

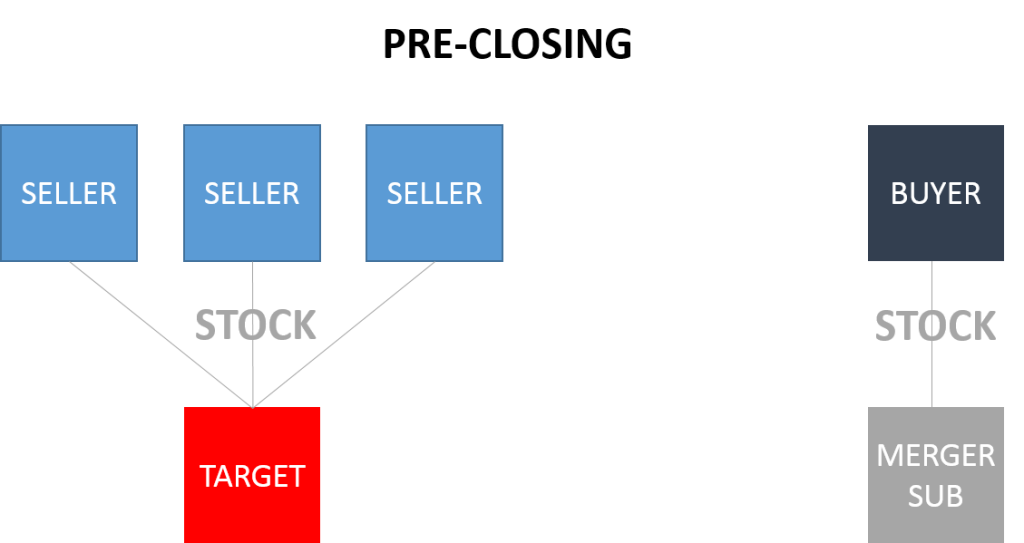

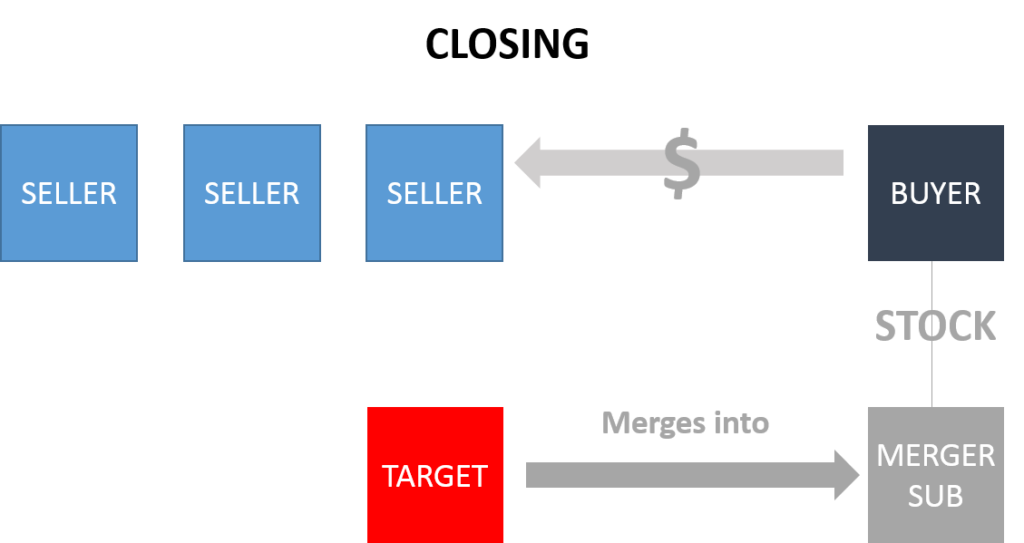

- Mergers: The two companies combine to form a new entity, or one company absorbs the other. Here is an illustration of a merger:

More complex structures, like forward and reverse triangular mergers, may be used to combine both asset and stock sales. Regardless of the structure, the outcome is typically that the seller receives payment and the buyer gains ownership and control of a new business.

With these insights, companies can make better-informed decisions in M&A transactions, securing deals that align with their long-term objectives.